If earnings are decreasing while interest expense is increasing, it will be more difficult to make all interest payments. Company founders must be able to generate earnings and cash inflows to manage interest expenses. These two liquidity ratios are used to monitor cash collections, and to assess how quickly cash is paid for purchases. Eliminate annoying banking fees, earn yield on your cash, and operate more efficiently with Rho. She has specialized in financial advice for small business owners for almost a decade. Meredith is frequently sought out for her expertise in small business lending and financial management.

Total Asset Turnover Calculation Example

It would not make sense to compare the asset turnover ratios for Walmart and AT&T, since they operate in different industries. Comparing the relative asset turnover ratios for AT&T with Verizon may provide a better estimate of which company is using assets more efficiently in that sector. From the table, Verizon turns over its assets at a faster rate than AT&T.

- This means that every dollar invested in assets generates $2 in sales.

- For the final step in listing out our assumptions, the company has a PP&E balance of $85m in Year 0, which is expected to increase by $5m each period and reach $110m by the end of the forecast period.

- To do so, divide the company’s net sales (or total revenue) by its average total assets formula during a specific period.

- Thus, to calculate the asset turnover ratio, divide net sales or revenue by the average total assets.

- This article explores the times interest earned (TIE) ratio, provides several examples of its application, and explains how your business can improve the ratio’s value over time.

Experience better expense management, today.

This is useful for evaluating your own performance as well as deciding where you need improvement. Ratios of companies with low working capital needs may get away with 0.5 or less. Asset turnover ratio is one of the most crucial business stats and accounting formulas to know. Plus, the asset turnover ratio can come in handy when you’re looking into business funding. Asset turnover ratio is a calculation used to measure the value of a company’s assets relative to its sales or revenue. It’s used to evaluate how well a company is doing at using its assets to generate revenue.

Which of these is most important for your financial advisor to have?

Your asset turnover ratio is an equation to help you figure out how you’re using your assets to generate sales. In much simpler terms, by finding your asset turnover, you can figure out how many dollars of sales you’re generating for every dollar in the value of assets you have. This accounting principle is a peek into the efficiency of your business—whether or not you’re using the assets you have, both fixed and current, to generate sales. The asset turnover ratio formula is net sales divided by average total sales.

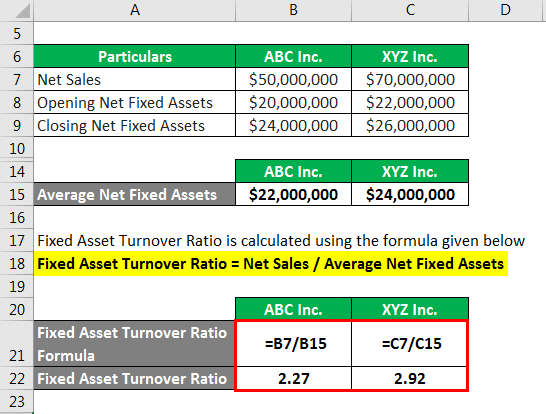

Interpreting FAT

And as we have the assets at the beginning of the year and the end of the year, we need to find out the average assets for both companies. Yes, excessively high asset turnover may indicate that a company is too aggressive in managing its assets, potentially sacrificing long-term growth or quality for short-term gains. An efficient company can the asset turnover ratio is calculated as net sales divided by deliver on its desired level of sales with a reasonable investment in assets. This means that for every dollar in assets, Sally only generates 33 cents. In other words, Sally’s start up in not very efficient with its use of assets. Suppose a company generated $250 million in net sales, which is anticipated to increase by $50m each year.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Companies should strive to maximize the benefits received from their assets on hand, which tends to coincide with the objective of minimizing any operating waste.

For instance, the company can develop a better inventory management system. A company will gain the most insight when the ratio is compared over time to see trends. Companies with strong ratios may review all aspects that generate solid profits or healthy cash flow. FAT only looks at net sales and fixed assets; company-wide expenses are not factored into the equation. In addition, there may be differences in the cash flow between when net sales are collected and when fixed assets are acquired. Asset turnover is not strictly a profitability ratio; it only measures how effectively a company uses its assets to generate sales.

One variation on this metric considers only a company’s fixed assets (the FAT ratio) instead of total assets. Sometimes, investors and analysts are more interested in measuring how quickly a company turns its fixed assets or current assets into sales. In these cases, the analyst can use specific ratios, such as the fixed-asset turnover ratio or the working capital ratio to calculate the efficiency of these asset classes. The working capital ratio measures how well a company uses its financing from working capital to generate sales or revenue.

The ratio is commonly used as a metric in manufacturing industries that make substantial purchases of PP&E to increase output. Investors monitor this ratio in subsequent years to see if the company’s new fixed assets reward it with increased sales. Rather, in that case, we need to find out the average asset turnover ratio of the respective industries, and then we can compare the ratio of each company. Total assets is the cumulative amount of everything your business owns. Average total assets is calculated by adding up all your assets and dividing by 2, since you are calculating an average for 2 periods (beginning of year plus ending of year). Though ABC has generated more revenue for the year, XYZ is more efficient in using its assets to generate income as its asset turnover ratio is higher.

The asset turnover ratio measures how effectively a company uses its assets to generate revenues or sales. The ratio compares the dollar amount of sales or revenues to the company’s total assets to measure the efficiency of the company’s operations. To calculate the ratio, divide net sales or revenues by average total assets.

Debts may include notes payable, lines of credit, and interest expense on bonds. This article will discuss all you need to know about asset turnover ratios. You’ll learn what they are, how you can use them to analyze businesses and more. They can also be used internally by managers to evaluate their various divisions.